Debt Literacy and Debt Literacy Self‐Assessment: The Case of Poland

Debt Literacy and Debt Literacy Self‐Assessment: The Case of Poland

Abstract

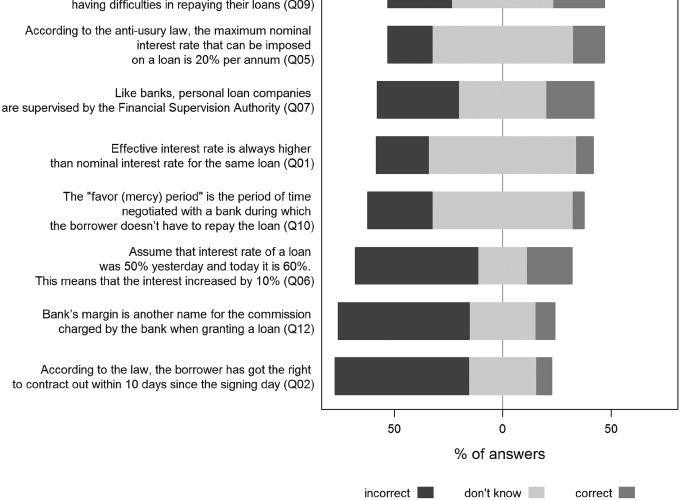

It is well documented that financial literacy is at best moderate around the world and that the cost of ignorance in this field may be high on both microeconomic and macroeconomic levels. We surveyed a representative sample of Poles to measure their debt literacy—a little‐studied aspect of financial literacy—and therefore obtain insight into the factors predicting it. Our study evidenced low levels of debt literacy and its overestimation by respondents in their self‐reports. We also confirmed some of the patterns found in former studies, including the gender gap and a positive relationship between the level of educational attainment and debt literacy. Finally, our examination provides compelling outcomes with regard to the segmentation of the sample on the basis of objective and subjective debt literacy scores. They show large heterogeneity of debt literacy and thus confirm the need for far‐reaching customization of debt‐oriented education.